Pension scams:

When will the penny drop?

Sleight of hand

Twenty four million: this is the figure the UK financial services regulator, the Financial Conduct Authority, has given for the number of vulnerable customers in Britain.

At any given time, these people will be interacting with the financial services profession, either for savings, pension, protection or mortgage products.

Yet behind their need or desire for a financial product lies a person with emotional, physical, mental and environmental vulnerability, caused by any number of extraneous or internal factors.

Covid-19 has exacerbated people's financial fragility as well as their mental and physical ill-health. People who had felt they were 'doing okay' have suddenly found themselves exposed and vulnerable.

These are the people most susceptible to scammers, and financial fraudsters have been having a field day since Covid-19 sent the whole world into lockdown.

According to Action Fraud, between September 2019 and September 2020, Action Fraud received more than 17,000 reports of investment fraud.

This amounted to £657.4m in reported losses – a 28 per cent increase when compared to the same period last year.

And people's hard-earned pension savings appear to be most at risk. Last year, the FCA and The Pensions Regulator reported that a total of £30,857,329 has been lost to pension scammers since 2017.

This was based on complaints filed with Action Fraud. The scams – which saw sums of between £1,000 and £500,000 lost to criminals – were perpetrated not just against the elderly and lonely but also the young, the under-advised, the isolated and the financially less aware members of society.

£657.4m lost to fraudulent activity from September 2019 to September 2020

More than 17,000 individual reports made to Action Fraud during the 12 months between September 2019 and September 2020

Work is being carried out at all levels – government, regulators, financial services providers and the third sector – to educate and protect consumers.

But while various measures are being put in place, what more can advisers do to help raise awareness and protect vulnerable clients?

This report aims to showcase work done by advisers and providers in the pensions space to root out and reduce pension scams; to explain what the government is attempting to do to combat pension theft; and to highlight best practice within the industry that seeks to take the oxygen out of these so-called 'white collar criminals' and protect consumers.

The feature below qualifies for an estimated 40 minutes' worth of structured CPD.

"There's a lot we can do to protect people against pension scams"

Keith Richards, chief executive of the Personal Finance Society, says: "Financial Advisers are more likely to spot potential scams than unsuspecting members of the public.

"So we do have a role to play in policing the airwaves – being alert, spotting something and pass it onto the FCA."

But, as he says, it is also about protecting the family and friends of clients – encouraging the client to help engage with a potentially wider base.

Advisers have offered thousands of hours' worth of pro-bono work over the past few years, according to the PFS.

He also encourages advisers to signpost the FCA's ScamSmart page on their own websites to help raise awareness of pension scams and let viewers know to whom potential financial scams should be reported.

Photo: NeoSiam via Pexels

Photo: NeoSiam via Pexels

The Great Pensions Steal:

Now you see it...

... Soon, you won't.

Everything changed that night at the New York Hippodrome on January 7 1918.

The time and place marked the moment when magician Harry Houdini made a full-size, living elephant disappear in front of a packed audience. The spectators were spellbound.

New York papers ran with the story for days: society speculated and journalists attempted to ferret out the secret to making such a large creature 'disappear into thin air'.

Houdini never revealed his secrets, although we know the elephant must have always still been there on stage, concealed by artistry and showmanship.

But there is a world of difference between an artist making things seem as if they have disappeared, and a con artist actually disappearing with your money.

And the tale of the Disappearing Pension is a much bigger one than even that of the mysterious Mr Houdini: it is one that affects hundreds of thousands of Britons, and instead of ending in awe, it ends in tears for too many households.

In fact, the figures relating to people's vanishing pensions are stark:

- £30.85m of people's hard-earned pension savings have been lost in the three years from 2017 to 2020, according to TPR and FCA analysis of reports made to Action Fraud.

- In 2015 the Project Bloom initiative was set up to tackle pensions fraud. At the time, an estimated £1bn had been whisked away by pension scams, according to agency PensionWise.

- By 2019, Project Bloom found some victims of pension scams have lost more than £1m each in savings to fraudsters.

- More than 5m pension savers were said to be at risk of falling for the tactics used by scammers in 2019, according to the FCA, but it warned that since the Covid-19 pandemic, scam activity increased.

- Aviva reported that in the three months from March to July 2020, pension scams made up 16 per cent of all suspicious reported activity.

It is clear despite the efforts of regulators since 2015, the problem is not getting easier to manage: Covid-19 has exposed people's vulnerabilities and susceptibility to falling prey to telephone and internet-based scams.

The latest FCA consumer investments data review 2020, published on January 18, has called the effects of pension scams “devastating” for consumers.

The report said: “When a consumer falls victim to a pension scam or money from their pension ends up in investments that are not appropriate for them, their losses can be devastating.

“We have a specialist supervision team that focuses on cases where we suspect potential pensions harms.

“This includes scams involving pension liberation and pension transfers or where we suspect unsuitable advice has led to a consumer ending up in investments that are clearly not suitable for them.”

The figures keep rising. Among the 1,542 scam cases investigated in 2020, 135 were opened by the FCA's specialist pensions team in 2020.

This was a 24 per cent increase on the number of cases opened in the whole of 2019 (109).

These cases have already resulted in 10 companies varying their permissions so they can no longer undertake the activities that caused consumers harm.

A further two cases have been referred to enforcement.

These headline figures peak to the depth and breadth of the problem: people's pensions are at risk.

Neil MacGillivray, head of technical support at James Hay, comments: "Some scams are obviously phoney but many are not, and their cleverness puts them several steps ahead."

However, no sooner has one fraud been stopped than another rears its ugly head.

As Mr MacGillivray says: "By the time the regulator is knocking down one scam, the fraudsters have moved on and opened three more."

What can be done?

Ros Altmann, former pensions minister and independent pensions consultant, says better, official guidance is a starting point: "Firstly, auto-enrol people into PensionWise before they move money out of a pension fund."

To this end, Labour MP Stephen Timms, chairman of the Work and Pensions Committee, brought an amendment to the pensions schemes bill in 2020 that would have made an appointment with PensionWise automatic.

However, this amendment was overturned in the bill's passage through Parliament.

By the time the regulator is knocking down one scam, the fraudsters have moved on and opened three more

According to Mr Timms: "The government set up PensionWise alongside the pension freedoms. A key part of the pension freedoms legislation was this guidance guarantee.

"PensionWise is the implementation of that promise. We argued – and I feel strongly about this – that PensionWise needs to be much more widely taken up than it is now."

Mr Timms says he will not stop in his quest to make sure people are given the best possible guidance.

"The default should be a PensionWise appointment," he adds.

There also needs to be better reporting and monitoring. In 2020, the Police Foundation produced a report calling for a database to be set up for the different agencies to draw on and share information about scammers and scams.

Lady Altmann would like to see an industry-led "early warning register where pension providers or advisers, or the public, can report potential scams" and this information could be confidentially sent to all pension providers.

Reporting can take the oxygen out of scammers, and this is something that Mike Morrow, wealth and platforms director for national adviser Openwork, strongly advocates.

He says: "While scams can be reported to the FCA or TPR, advisers have in the past complained that action to investigate these can take too long and consumer detriment results of the ensuing delay.

"A 'potential problem' list that goes to providers could help raise important red flags, while allowing providers and advisers to make the necessary due diligence checks before giving a transfer the green light."

Acting long after thousands of people have been put at risk is not in the public's interest

If guidance and 'red flag' lists are not enough, should there be higher restrictions on transfers?

Lady Altmann thinks so: "If a pension provider never transferred funds out, there would not be any scams.

"If we want transfers to occur, we have to help people avoid the rogue schemes."

Clearly, one cannot stop all transfers; to do so would be against the spirit of pension freedoms and would be to the detriment of many clients for whom a transfer would lead to the best financial outcome.

That said, the regulator is concerned that too many transfers have been going ahead, not because it is best for the client but because an uncertain economic environment and persistently high transfer values have combined to make that transfer too tempting a prospect.

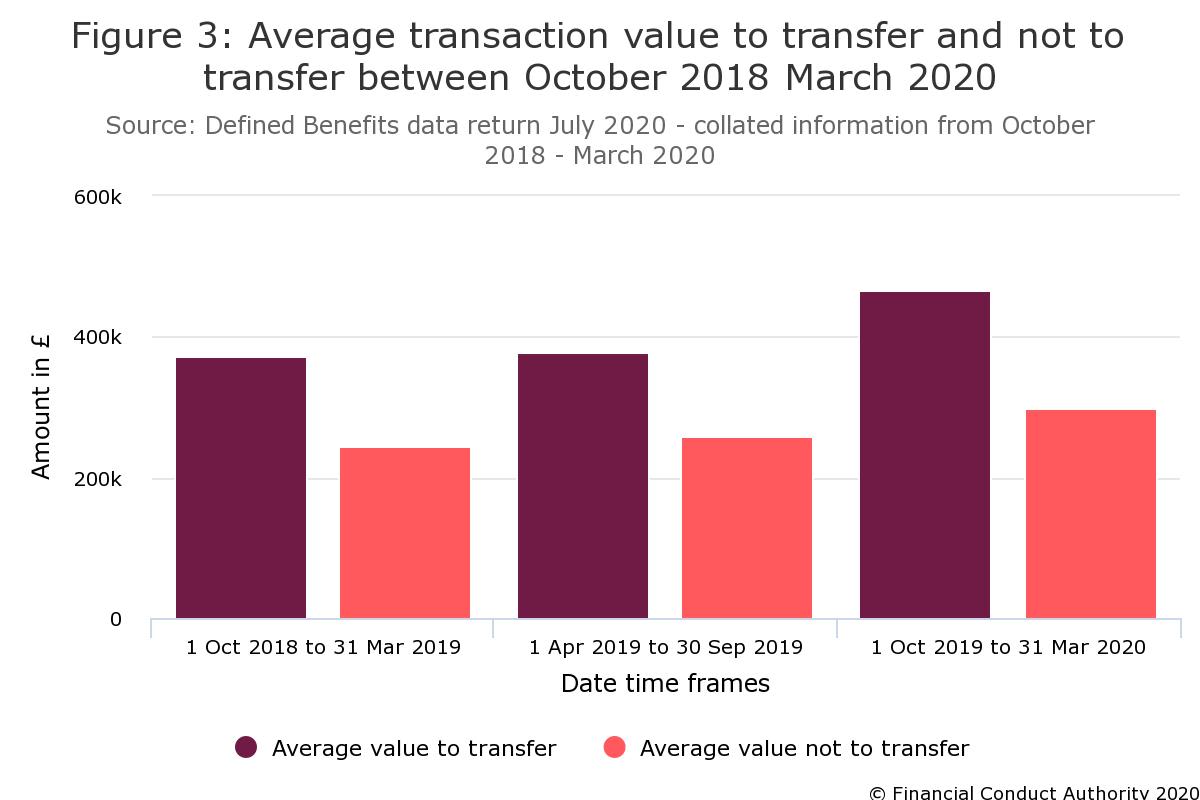

The chart opposite shows just how high transfer values are, compared with values for not transferring.

The latest FCA findings on defined benefit transfers, from its market data research carried out between October 2018 to March 2020, showed 49,456 clients were given a recommendation to transfer. This made up 57 per cent of all transfers.

Worryingly, of the 49,456 clients advised to transfer, only 500 (1 per cent) were transferred to a workplace pension scheme between October 2018 and March 2020.

Where did the rest of the money go? Overseas? To potentially higher-risk investments within self-invested personal pensions? As the FCA itself stated, this was a concern, given the tax breaks and employer contributions that make up a workplace pension.

The FCA report stated: “We expect all firms providing DB transfer advice to have appropriate professional indemnity insurance cover in place, in line with our rules. If they don’t, they must not carry out DB transfer advice.”

Yet the FCA found 119 companies (9 per cent of those advising on DB transfers during that period) did not have PII cover.

More needs to be done to curb these worrying practices – and it seems enforcement will only occur if and when something comes to light that proves the advice was wrong.

Lady Altmann called this “shocking”, and urged the regulators to do more. She said: “I do hope the regulators will move towards a more proactive approach to protecting consumers, rather than the current tendency to be only reactive.

“Acting long after thousands of people have been put at risk is not in the public's interest.”

It must be stated not every recommendation to transfer is a scam, but this has been widely noted, from government level down to advice company level, as a significant weak link in the chain, and a route via which thousands of people have lost nearly every penny saved in their pension pots.

Pension fraud is an urgent and potentially devastating crime for its victims and the problem is not going to go away on its own

And it is not always a direct action of the adviser that is censured – often an adviser is reprimanded for the sin of omission, that is, not doing what it should to stop a raid on a client’s pension by a third party.

For example, FTAdviser recently wrote on the ruling from the Financial Ombudsman Service, which ordered advice company Charterhouse Independent Financial Advisers to compensate a client after their pension pot was raided by "malign" fraudulent activity.

The Fos found that Charterhouse was responsible for failing to stop a fraudulent withdrawal from their client’s Sipp in 2018.

As a result, ombudsman Kevin Williamson ordered the company to reimburse the client’s pension by nearly £8,000, to cover any missed investment returns and to pay £250 for the trouble and upset caused.

Government in action

The government and regulators are not being idle, though thousands of victims may feel this is the case.

The government is seeking to act on scams and the ease by which fraudsters can raid pension pots of consumers, whether they are advised or not.

It also passed the pension schemes bill on January 19, giving greater protections to workplace pensions and providing consumers with better technology to enable them to keep an eye on their pots.

The bill contains, among others, measures to:

- Better protect member benefits in workplace schemes.

- Provide a framework for a future pensions dashboard.

- Prevent material detriment to pension schemes.

This soon-to-be act will help protect members of workplace pensions, but what happens when the member comes to retire?

How can you protect them from some scammer's sleight of hand? What's to stop members placing their pots with some clone company or similar white-collar fraudster?

Information and education are key, the WPC has claimed. But while Mr Timms’ amendment for an automatic PensionWise appointment did not make it into the bill this time, he will not give up pushing for a more informed consumer.

Moreover, he is adamant the industry, led by government, must have a more joined-up approach.

He says: "We have this situation where there is a curious fragmentation of various bodies. We have Action Fraud, the FCA, TPR, the Pensions Ombudsman, the Fos, the police – everything is so fragmented.

"And therefore people aren't quite sure who to report to, so co-ordinating the enforcement and policing resources around this is one of the things that has to happen."

He states the WPC will continue to do more to make sure the industry plays its part, too.

"Our inquiry is still under way and we haven't yet formulated our recommendations but I am concerned this fragmentation of the policing response is one of the things we need to tackle."

Mr Timms stresses the point that a co-ordinated approach is the best way to tackle scams, and says this should be led by the government.

"We have got to gear up to respond effectively to [scams]. There is a lot the government needs to do."

Andrew Tully, technical director at Canada Life, comments: “I welcome the WPC’s continued interest to co-operate with the industry and tackle the problem.

“Pension fraud is an urgent and potentially devastating crime for its victims and the problem is not going to go away on its own.”

![[object Object]](./assets/beXK6jk9R0/img-546x712.jpeg)

Original poster from the Hippodrome. Creative Commons

Original poster from the Hippodrome. Creative Commons

![[object Object]](./assets/tzNh2snx0t/neil-macgillivray-james-hay-513x542.jpeg)

Neil MacGillivray, James Hay

Neil MacGillivray, James Hay

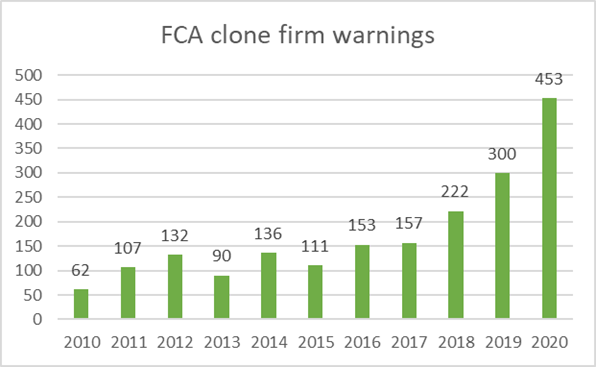

Number of fake firms rose exponentially in 2020, according to FCA data

Number of fake firms rose exponentially in 2020, according to FCA data

Interrogating the enforcers at the WPC

The WPC has already held many inquiries as part of its three-part investigation into the impact of the 2015 pension freedoms, the first part focusing on pension scams, and will be bringing out its first report in the next few months.

On January 6, the WPC held a session at which TPR, the FCA, the National Economic Crime Centre and the economic crime unit at the City of London Police were represented.

During the session, TPR revealed at least £54m of lost pension savings were under investigation, involving more than 18,000 savers. The WPC heard this was likely only to be a fraction of the scale of the problem as many cases will go undetected for years.

But there was a glimmer of hope: WPC member Chris Stephens MP asked why intelligence-sharing in the pensions industry was not as “comprehensive” as in other sectors, such as in insurance.

Responding, Graeme Biggar, director general of the NECC, said: “There is definitely scope for more information-sharing within industry and then between industry and regulators and law enforcement.

“We have been working more recently on trying to make sure we are getting more developed information-sharing, so packages of information-sharing rather than just individual reports, because we can do a lot more with it if we proceed like that.”

Source: Pexels

Source: Pexels

What can the ‘little guy’ do?

While the government and regulators are busy with high-level legislation and investigations, there are many practical things providers and advisers can do.

For example, Stephen Fletcher, deputy chief executive at Arbuthnot Latham, says: “Our advisers are constantly reminded and trained to keep talking to our clients regarding online and cold-calling scams.

“Criminals are constantly on the lookout for new and innovative ways to try to steal people’s money and information."

He says the company tells clients: “Be vigilant, do your research around a company before parting with money, do not be pressured into handing over any money/information and, if in any doubt whatsoever, contact your bank using information that you have obtained independently or already know to be correct.”

But it is not just about issuing warnings: it is also about understanding a customer's potential vulnerability and making sure all customer-facing advice staff are trained to spot this.

James Hay's Mr MacGillivray says: “Supporting vulnerable customers has been an important focus for us.

“We train our colleagues on spotting the signs and how we can then offer appropriate support, and we’ve developed help for advisers and paraplanners, including sharing best practice at a recent webinar.”

Webinars and other tech advances can help spread the message, too.

According to Openwork's Mike Morrow – who is to become network's the chief commercial officer at the end of January – technology can help to give people more oversight and information about their pension pots.

He acknowledges arguments can be made that technological advances have also benefited the faceless fraudsters.

We make no apologies for keeping talking to clients about such dangers

Mr Morrow says tech can "lull customers into a false sense of security, as can be seen through the success of phishing and other scams".

However, Mr Morrow also argues that better, more secure technology in the hands of consumers can help them to monitor their savings much more closely.

He explains: "Technology helps to track and record differing pension pots and make customers aware of their holdings, values and options.

"Better encryption and use of two-step verification can help and enable customers check the validity of a potential third party."

Mr Fletcher agrees: "Education is key. We regularly contact all clients directly via email and post to remind them of the dangers and give specific examples of the types of scams that fraudsters use. "

Lady Altmann says if the financial services industry and government really wants to help prevent vulnerable people making knee-jerk and damaging decisions about their pensions, they need to know more.

She explains: "[We need] a proper education campaign extolling the virtues of pensions and helping people understand how precious they are.

"Guaranteed pensions are like gold dust and some people have many different deferred pensions.

They should be careful to understand the reasons why someone might want to transfer – such as if they are in poor health, or if they have plenty of other guaranteed pensions and want to use the inheritance benefits."

Mr Fletcher agrees: “Before the pandemic, we also ran regular face-to-face seminars for our clients, briefing them on the dangers and providing real examples.

“We make no apologies for keeping talking to clients about such dangers, as no matter how sophisticated a client is, fraudsters are clever and often one step ahead, so everyone has to have this in the front of their minds at all times.

“Stop and think before doing anything – this is the message we want to drive home.”

It is clear that while enforcement and government action has a massive part to play, as well as better systems allowing for better 'track and trace', nothing can beat working with trusted, authorised professionals when it comes to spotting and stamping out scams.

Mr Morrow adds: "Working with a trusted and reputable financial adviser who you know and recognise is vital.”

By Simoney Kyriakou

This feature qualifies for an estimated 40 minutes' worth of structured CPD, which you can bank at the end of the report.

Stephen Timms, chairman of the Work and Pensions Committee

Stephen Timms, chairman of the Work and Pensions Committee

Source: Pexels

Source: Pexels

Case Study: Nicholas Lant

"Nobody is safe"

In the space of a few minutes, he had secured my pension fund and analysed that it was a fraud

In 2019, consumer Nicholas Lant was approached by an unknown pension ‘adviser’ offering him a transfer of his pension to a complicated scheme that could allow him to access his pension funds prior to 55, all tax-free.

It sounded too good to be true: and it was.

Mr Lant admits falling for the scam; but his money was saved after he mentioned it to his financial adviser, who quickly investigated and worked with Royal London to stop his client losing his hard-earned pension pot.

The adviser, Alex Binnington, IFA for Pareto Financial Planning, spoke with FTAdviser:

Q: When did you or your client first realise something was amiss?

A: He’d been a client of mine for a year or so at the time. He contacted me to explain that he was worried that he’d fallen for a scam. He’d signed some paperwork, while at a particularly low ebb. He realised the next day the risks of what he’d done, panicked and called me in quite a distressed state. He sent me copies of all the contact he’d received and asked if I could help reverse everything he’d signed.

Q: How had the scammer managed to get hold of your client?

A: He responded to an email campaign from an overseas-based company, with UK ‘agents’, suggesting he could transfer to a (very complex) scheme that would allow him to access funds prior to 55, all tax free. This appealed to him, as he was under 50 and was short of accessible funds.

Q: Would you say your client was vulnerable at the time, or would be considered vulnerable?

A: Yes, he was definitely a vulnerable client and I’d recognised as such, from our very first contact.

Q: How did you work to stop the scam?

A: I immediately contacted Royal London, explaining what had happened and asking them to put a stop on any transfer requests. I also made our back office aware not to action any requests for information or to action a transfer request.

Q: What was particularly shocking to you about the scam?

A: The blatant misinformation (lies), lack of ethics and high fees. There was no advice, the decision making was firmly placed onto the client. No care from them as to the client’s level of understanding, level of vulnerability, his actual real-life circumstances and affordability, nor any consideration of the resulting impact of transferring his money. The ‘adviser’ fee of around 15 per cent for facilitating the transfer to the overseas scheme was extortionate.

Alex Binnington, pictured, saved his vulnerable client's pension pot.

Alex Binnington, pictured, saved his vulnerable client's pension pot.

Q: How easy is it, in your view, for people without an adviser to fall for this sort of scam?

A: Unfortunately, I think it could be very easy. If a client doesn’t have an adviser relationship, does not have the ability to manage their own finances or deal directly with a provider, then those who are of a vulnerable nature could easily fall prey to scams.

Q: What action can advisers and providers take together to help stamp out pension scams in the future?

A: I don’t know how this can be done, but there needs to be some reinforcement of the value of having an IFA. The profession needs to be held in higher regard by the public, and seen as advice, not sales.

I think with vulnerable clients, it’s a case of recognising early on that more time and patience is needed to build trust and cement the working relationship. Hopefully this means the adviser will always be the first port of call, to keep reinforcing why certain solutions have been recommended, the risk and benefits of those recommendations and, importantly, why alternative options have been eliminated.

Advisers have a responsibility to inform clients that scams are actively being peddled and what to look for. Providers should do more of the same. Providers could put a further layers of security into their processes. This does happen in a lot of cases, where providers write to clients to clarify their instructions and request further signatures.

Government advertising for public awareness needs to continue and be better than it is. As well as pointing out the damage caused by scams, highlight the benefits of how a quality adviser can help, otherwise the public are frightened, thinking all advisers are potential scammers – although this is difficult I realise, as some still are.

Their adverts only cover 50 per cent of the issue though. The FCA need to tighten up on non-regulated products being advertised.

Mr Lant said he would urge anyone in a similar situation to speak with a professional financial adviser.

He told FTAdviser: “I was approached to move my pension fund into a scheme where I was to be a director of my own company and able to access funds before I was 50.

“I would not own my fund and therefore not liable for tax, I was told.

“After getting some information, I thought it was too good to be true. I rang Alex [Binnington]. He took control and spoke to Royal London.

“In the space of a few minutes, he had secured my pension fund and analysed that it was a fraud.

“Since then, Alex has been with me all the way and helped to gain a significant increase in my fund. My advice is always use an adviser: it will save you thousands of pounds and your mental state.”

Helen Morrissey, corporate PR specialist – long-term savings at Royal London

Helen Morrissey, corporate PR specialist – long-term savings at Royal London

According to Helen Morrissey, corporate PR specialist – long-term savings at Royal London, "nobody is safe" from being approached by pension scammers.

However, the great news is that advisers and providers are prepared to put in the legwork to help protect clients when a red flag is raised.

She said: “This case is a great example of how advisers and providers can work together to help protect the customer’s best interests.

“We believe building strong relationships with advisers and their clients is key to identifying potential scams early, so we can all work quickly to stop the scammers in their tracks.”

Simoney Kyriakou is senior editor at FTAdviser

"Always use an adviser: it will save you thousands of pounds and your mental state."

- Nicholas Lant

Bank your CPD here: